Highly unlikely.

Highly unlikely.

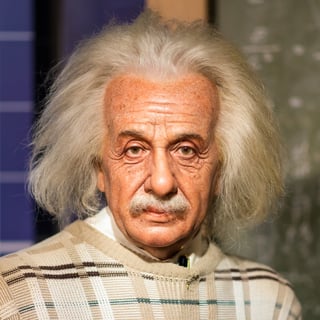

In fact, decades ago, the eminent scientist Albert Einstein defined insanity as “doing the same thing over and over again and expecting different results.”

So here’s the issue: if all of us have heard this before, which we have, why do we continue to do it?

In banking, it could be largely due to the persistent inertia in bank marketing. According to Michael Raneri, managing director of PricewaterhouseCoopers’ financial advisory practice, rather than taking on significant change, “there’s inertia that leads banks to incrementally improve what already exists.”

It always seems that last year's tactics and campaigns somehow find their way into the current year’s plan.

The always-repeated tactics might include things like

- an annual photo calendar contest,

- updating little-used product brochures so the take-one racks don't look dumb,

- a quarterly hard copy newsletter,

- email marketing not linked to any larger strategy, and

- haphazard social media presence.

Clearly, Einstein was onto something.

If you want to start to see genuinely different and better results for systematically growing your business loan portfolio, investing in an inbound marketing program could be smart money management on your part!

Think about it: today’s business borrowers don't need to be convinced that they need a loan. They’ve already done the basic online research. For them, now it's about finding information about the lender they'll be working with. They have questions: wouldn't you want to be a source they’d look to for the answers?

Answering the questions your prospects have - when they have them

Inbound marketing for banking is about providing relevant content your ideal prospects are looking for, and providing it online, which is where they're looking for it. They’re looking at your website, seeking information on your blog, or in downloadable content.

Inbound marketing is a great fit for financial institutions. You'll no longer have to be wasting time on low-return tactics like cold-calling business owners who may want a loan at some future point. Instead, your website and other inbound marketing tactics will be built around attracting people who are ready to tell you that they're looking for a loan, and for information about that loan. Lead generation problem solved.

Want to learn more? You may like this customizable spreadsheet to help you calculate returns you could start to get from a regular program of inbound digital marketing for your lending business.